Planned giving

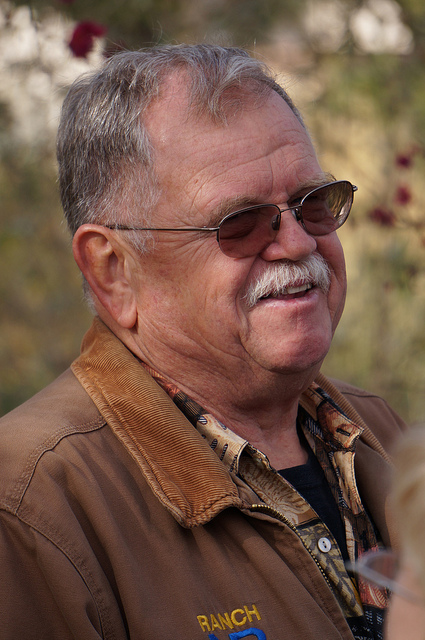

Warren G. Roberts Arboretum Legacy Society

We have created the Warren G. Roberts Arboretum Legacy Society to recognize people who have created endowments or included the UC Davis Arboretum and Public Garden in their estate planning.

We have created the Warren G. Roberts Arboretum Legacy Society to recognize people who have created endowments or included the UC Davis Arboretum and Public Garden in their estate planning.

Planned giving often allows donors to make larger gifts than they may have thought possible. Planned gifts are gift arrangements that have specific tax advantages and often include lifetime income to a beneficiary or beneficiaries named by the donor.

Reference guides

We encourage you to consult your personal financial adviser about making a gift. UC Davis staff are also available to discuss your personal financial situation in confidence and to respond to requests from attorneys, accountants and financial planners. Please download our planned giving chart, an easy reference guide to planned gifts.

Bequests

Bequests are made by naming the UC Davis Arboretum and Public Garden as a beneficiary in your will or living trust. They often serve as the cornerstone of planned giving, and as the first step in creating a philanthropic legacy. A bequest for any amount can be made by anyone, at any age, with a will or trust. You and your legal adviser are encouraged to consult with the UC Davis Planned Giving Office regarding the gift language to ensure your intentions are fulfilled.

Life-income gifts

Life-income gifts make it possible to support the Arboretum and Public Garden and also provide income for you (and others) at the same time. To establish a life-income gift, donors irrevocably transfer assets to a trust, a pooled fund, or to the university. Depending on the terms of the agreement, periodic payments are made to the donor and/or a beneficiary for life or for a term of years. Ultimately, the assets are distributed to the campus to be used for the donor’s designated purpose.

- Charitable gift annuities provide fixed, partially tax-free payments. A gift annuity is a simple, contractual agreement between a donor and the university in which a donor transfers assets in exchange for the university’s promise to pay one or two annuitants payments for life.

- Charitable remainder trusts provide income to the beneficiary(ies) for life or for a set number of years. A charitable remainder unitrust generates payments based on a fixed percentage of the annual value of the trust assets. The payout will vary from year to year. A charitable remainder annuity trust pays a set dollar amount annually based on the initial value of the trust assets. The payout remains constant each year.

For more information about creating a planned gift to benefit the Arboretum and Public Garden, please contact Suzanne Ullensvang at sullensvang@ucdavis.edu. For additional resources, visit plannedgiving.ucdavis.edu.